44+ Can I Exclude A Credit Card From Chapter 7

3920 Tax Relief for Victims of Terrorist Attacks. Web Electronic Form 1024-A.

Pro Forma Earnings Uses And Examples Of Pro Forma Earnings

On April 4 2022 the unique entity identifier used across the federal government changed from the DUNS Number to the Unique Entity ID generated by SAMgov.

. 6 to 30 characters long. 628 and announces that taxpayers may use either RESNET Publication No. Web This statutory code contains.

For a more detailed list of programs that do and dont use the guidelines see the Frequently Asked Questions FAQs. Web Moreover each house of Congress can expel or exclude members for insurrection or other reasons although it is uncertain whether more votes may be required to expel than to exclude. Form 1024-A Application for Recognition of Exemption Under Section 501c4 must be submitted electronically on Paygov.

Browse CFR Parts Affected from the Federal Register Browse final and proposed rules that affect the CFR and have been published in the Federal Register. Find out more on how we use cookies. Web You can exclude the value of benefits you provide to an employee under a DCAP from the employees wages if you reasonably believe that the employee can exclude the benefits from gross income.

Must contain at least 4 different symbols. The Unique Entity ID is a 12-character alphanumeric ID assigned to an entity by SAMgov. See My Options Sign Up.

The stance of fiscal policy. Natural persons should have control of their own personal data. The collections of information in this final regulation are in 1108-7d4.

The Earned Income Tax Credit program also does NOT use the poverty guidelines to determine eligibility. ASCII characters only characters found on a standard US keyboard. October 25 2022 25 Oct22 Apple patches new iPhone zero-day.

Faced with a recession driven by high inflation it is necessary for fiscal policy to work alongside monetary policy while providing targeted support to. 193 194 195 A further way that Congress can enforce Section 3 is via impeachment and even prior to the adoption of the Fourteenth Amendment Congress. For familieshouseholds with more than 8 persons add 4720 for each additional person.

116-94 clarifies that employees described in section 414e3B which include ministers employees of a tax-exempt church-controlled organization including a nonqualified church-controlled organization and employees who are included in a church plan under certain circumstances after. Web In addition you cant deduct 7 18 of the airfare and other expenses from New York to Paris and back to New York. 3507d under control number 1545-2155.

Web Box 1A. Final regulations provide that the requirement to report contributor names and addresses on annual returns generally applies only to. Details of legal requirements that you must follow without exception.

There is a convenience fee charged by these providers that varies by provider card type and payment amount. Web Examine all payments to the officer such as amounts labeled as draws loans dividends or other distributions to determine whether the payments are potentially wages for FICA FUTA and FITW purposes. Web The unique entity identifier used in SAMgov has changed.

Web 7 Those developments require a strong and more coherent data protection framework in the Union backed by strong enforcement given the importance of creating the trust that will allow the digital economy to develop across the internal market. Web Latest breaking news including politics crime and celebrity. 06-001 to determine whether a dwelling unit qualifies for the new energy efficient home credit.

Web Per OMB Circular A-123 federal travelers must provide a tax exemption certificate to lodging vendors when applicable to exclude state and local taxes from their hotel bills GSAs SmartPay team maintains the most current state tax information including any applicable forms. Web Janes The latest defence and security news from Janes - the trusted source for defence intelligence. 05-001 or RESNET Publication No.

Web This announcement is a ministerial update to Notice 2006-27 2006-11 IRB. Web To pay using a debit or credit card you can call one of the following service providers. Web The collections of information contained in these final regulations were previously reviewed and approved by the Office of Management and Budget in accordance with the Paperwork Reduction Act of 1995 44 USC.

Web The Definitive Voice of Entertainment News Subscribe for full access to The Hollywood Reporter. Web This site uses cookies to offer you a better browsing experience. Web SAP has announced third-quarter 2022 revenue of more than 78bn up 15 year on year with cloud revenue at 42.

You can deduct 11 18 of the round-trip plane fare and other travel expenses from New York to Paris plus your non-entertainment-related meals subject to the 50 Limit lodging and any other business expenses you had in. Web List of CFR Sections Affected The LSA includes proposed new and amended Federal regulations that have been published in the Federal Register since the most recent revision date of a CFR title. C The department by rule may require in addition to the amount of the fee or charge the payment of.

Reporting of donor information Form 990 990-EZ and 990-PF. Statutory guidance that you must follow by law unless theres a good reason not to. For more information see Sickness and Injury Benefits later.

Web 3 by means of a valid credit card issued by a financial institution chartered by a state or the federal government or by a nationally recognized credit organization approved by the department. Find stories updates and expert opinion. Web Google LLC ˈ ɡ uː ɡ ə l is an American multinational technology company focusing on search engine technology online advertising cloud computing computer software quantum computing e-commerce artificial intelligence and consumer electronicsIt has been referred to as the most powerful company in the world and one of the worlds most valuable.

Web You can exclude from income certain disaster assistance disability and death payments received as a result of a terrorist or military action. Division O section 111 of PL. Web Retirement income accounts.

An employee can generally exclude from gross income up to 5000 2500 if married filing separately of benefits received under a DCAP each year. 907 Tax Highlights for Persons With Disabilities. Examiners must address section 530 in all officer worker classification cases.

626 and Notice 2006-28 2006-11 IRB.

Pdf Credit Risk Scorecards Developing And Implementing Intelligent Credit Scoring Karamfila Stoykova Academia Edu

Can You Keep A Credit Card Out Of A Bankruptcy Walker Walker Law Offices Pllc

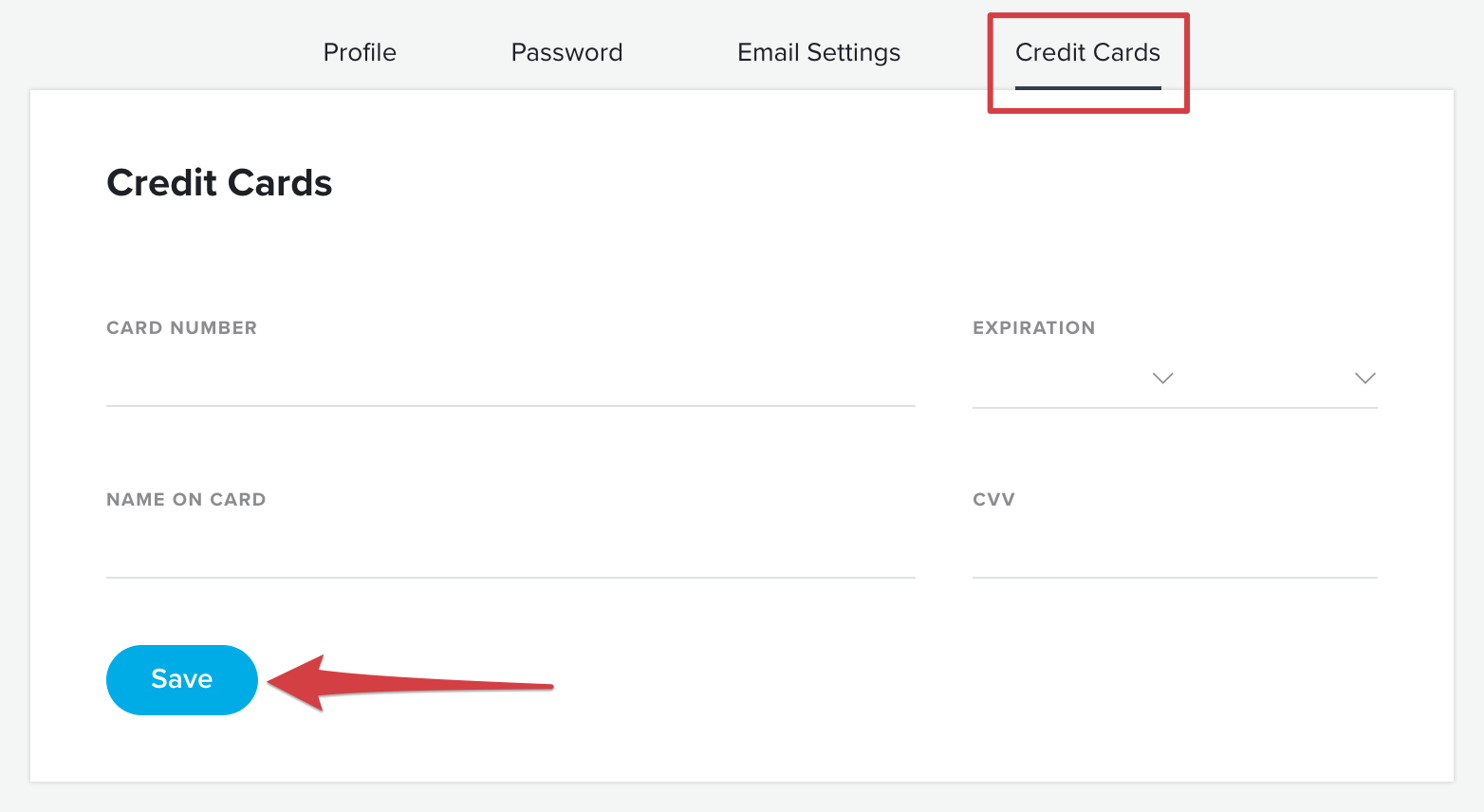

Manage Saved Credit Cards Quartzy Support

Master Budget Example And Components Of Master Budget

When To Stop Using Credit Cards Before Filing Chapter 7

Run Up Credit Cards Before Bankruptcy Maxing Out Nick Thompson Atty

Filing Bankruptcy For Credit Card Debt Allmand Law Firm Pllc

:max_bytes(150000):strip_icc()/woman-who-is-surprised-to-see-her-bank-account-while-paying-her-bill-1167717541-a26ef2ad52fa4ec28d65a435ae8114b5.jpg)

Can You Keep Some Credit Cards If You Declare Bankruptcy

Bankruptcy For Credit Card Debt Is It A Good Idea

Run Up Credit Cards Before Bankruptcy Maxing Out Nick Thompson Atty

Run Up Credit Cards Before Bankruptcy Maxing Out Nick Thompson Atty

Run Up Credit Cards Before Bankruptcy Maxing Out Nick Thompson Atty

If I File Chapter 7 Bankruptcy Can I Keep Any Credit Cards Legal Answers Avvo

Neu 14 0 Qhd Ips Display Bildschirm Panel Ag Au Optronics B140qan01 5 H W 0a F W 1 Ebay

Can You Keep A Credit Card Out Of A Bankruptcy Walker Walker Law Offices Pllc

List Inactive Credit Cards

Run Up Credit Cards Before Bankruptcy Maxing Out Nick Thompson Atty